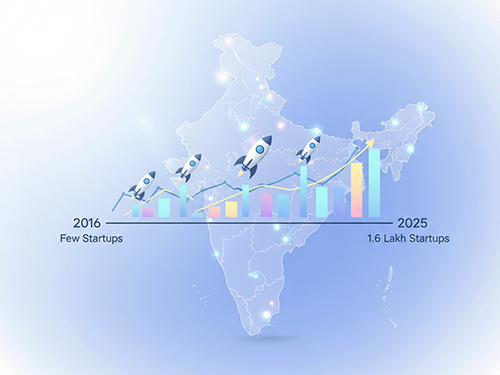

India’s Startup Boom: From Hundreds to Hundreds of Thousands

India’s startup ecosystem has exploded in recent years. By early 2025 India had over 1.6 lakh DPIIT-recognized startups– a dramatic rise from about 500 in 2016. This growth makes India the world’s third-largest startup hub. Government figures show 161,150 entities recognized by Jan 31, 2025, up from 140,803 in June 2024. These firms have collectively generated 1.66 million+ jobs, flipping India from a nation of jobseekers to one of job-creators (with success stories like Zomato, Nykaa and Ola).

Total Startups in India: Official Counts and Trends

Official data from DPIIT (the Startup India authority) is a key benchmark. As of Jan 2025, about 161,000 startups had DPIIT status granting them special tax and ease-of-doing-business benefits. This is up steeply from 140,803 in mid-2024. (Note: private trackers suggest the real number of startup companies in India is even larger, since many firms may not have applied for DPIIT recognition.) This nearly 320-fold jump since 2016 underscores the ecosystem’s meteoric growth. Importantly, DPIIT-recognized startups are already major employers – they have created over 1.66 million direct jobs. In short, the official count (now ~1.6 lakh) reflects a vast, expanding base of innovative ventures across India’s economy.

Key Sectors Driving Innovation

India’s startups span dozens of fields, but a few sectors stand out for scale and activity:

- Fintech: India is now one of the world’s largest fintech markets. According to NPCI/KPMG, there are about 6,386 fintech startups in India (~87% adoption of fintech services). Indian fintechs raised 129 funding deals in 2023 (one of the highest deal counts by sector), reflecting heavy investor interest in digital payments, lending and financial services innovation.

- E-commerce & Retail Tech: Online retail and direct-to-consumer brands continue to explode. KPMG reports that e-commerce startups led funding in 2023 with 192 deals. This is driven by India’s growing middle class and internet access, making shopping and consumer services a top startup focus.

- Edtech & Healthtech: Technology in education and healthcare has surged. The government highlights edtech and healthtech as priority sectors. Education startups – from K–12 online learning to skilling platforms – have expanded rapidly. Likewise, healthtech (telemedicine apps, AI diagnostics, robotic surgeries, etc.) is seeing a funding boom as Indian startups tackle healthcare access.

- Emerging Sectors: Other fast-growing verticals include agritech and deep tech. For example, India had 1,554 agritech startups (387 women-led) by early 2024, innovating in farming and supply chains. Cleantech, AI/ML-driven startups and space-tech ventures are also drawing attention. These sectors often benefit from targeted government support and a large local market.

In summary, India’s startup growth is not narrow but wide-ranging. Fintech and e-commerce lead by numbers and funding, while health and education tech are building future potential. The ecosystem is diversifying rapidly.

Leading Startup Hubs by Region

India’s startup activity concentrates in major cities and growing hubs. “Major hubs like Bengaluru, Hyderabad, Mumbai, and Delhi-NCR have led this transformation,” the government notes. Karnataka (centered on Bengaluru) and Maharashtra (centered on Mumbai) alone account for huge shares of the startup count. For instance, official data lists 28,511 DPIIT startups in Maharashtra vs 16,954 in Karnataka (both as of Jan 2025). These states host India’s premier tech clusters: Bengaluru, Delhi-NCR and Mumbai.

Bengaluru remains the top funding hub: startups there raised about $4.15 billion in 2023. In the first half of 2025, Bangalore-based companies accounted for roughly 26% of all startup funding in India, with Delhi NCR close behind at 25%. Mumbai’s startup scene (Maharashtra) is also significant – it has the largest number of DPIIT startups and received ~$1.46 billion in funding in 2023.

Other metro cities are hotbeds too. Chennai, Pune, Hyderabad and Kolkata each have thriving incubators and VC interest. KPMG notes Pune and Chennai even reached over $200 million in 2023 funding. Notably, many Tier-2 cities are on the rise: state-led initiatives have fostered startup growth in places like Indore, Jaipur, Lucknow and Ahmedabad. As a result, about half of new startups now originate outside the traditional metros – a trend encouraged by reduced operating costs and government policies.

Funding Trends and Growth Patterns

Startup funding in India has seen dramatic swings. A multi-year boom (peaking in 2021–22) gave way to a more cautious 2023–25. In H1 2025 India’s tech startups raised about $4.8 billion, a 25% drop from $6.4B in H1 2024. Despite this cooling, India climbed into 3rd place globally in startup funding (behind only the US and UK).

Sector-wise, new leaders have emerged. In H1 2025 transportation & logistics tech (think EVs, mobility platforms) attracted ~$1.6B – up 104% from the prior half-year. Retail tech and real-estate tech (led by big rounds in companies like Erishaa and Infra.Market) also saw high funding, totaling $1.2B and $1.1BBy contrast, many other segments saw flat or lower funding compared to 2024. Mega-deals (>$100M rounds) have become rarer: five Indian startups raised $100M+ in H1 2025 (versus 10 in H1 2024), showing that investors are more selective.

Geography of capital largely mirrors the hubs: Bangalore and Delhi still attract the lion’s share. Notably, the number of startup IPOs and acquisitions is ticking up, indicating maturation: 12 startups went public in early 2025 (vs. 21 in the same period of 2024) Overall, the funding environment reflects a transition from a frenzied growth phase into steady, quality-driven expansion.

Throughout these ups and downs, one constant is strong support. Schemes like the ₹945 Cr Seed Fund and ₹10,000 Cr Fund of Funds (FFS) continue to back early-stage startups. Credit guarantees and easier compliance help young companies survive the funding winter. On the demand side, a huge 20–30-year-old workforce and rising consumer market underpin long-term optimism.

In short, India’s startup ecosystem is thriving and diversifying. Official numbers confirm the scale – over 1.6 lakh DPIIT startups as of 2025 – but the real story is about momentum and possibility. From fintech innovation to rural agritech, from Hyderabad hubs to new centers in smaller cities, the ecosystem is igniting entrepreneurship across the country. For aspiring founders and investors alike, India’s startup journey offers both impressive progress and exciting opportunities ahead.

Leave a Reply