Predictive Compliance Management: Reducing Risk & Boosting Business Resilience in 2025

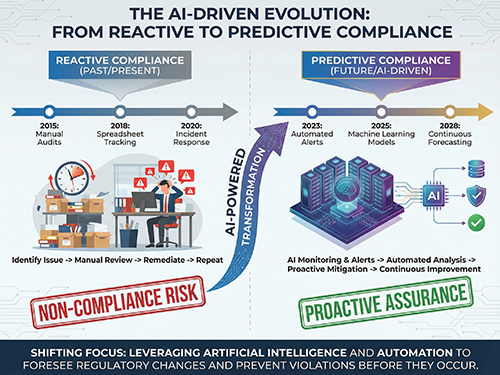

Compliance isn’t just about avoiding penalties anymore – it’s about predicting, preventing, and optimising compliance across evolving regulatory landscapes. New technologies such as artificial intelligence (AI), machine learning, connected data streams, and real-time dashboards are empowering businesses to move from reactive compliance to predictive compliance.

This is the future – where compliance isn’t just managed but anticipated.

1. What Is Predictive Compliance Management?

Predictive compliance uses a mix of:

- Real-time data feeds (financial, regulatory, HR, operations).

- AI and machine learning models.

- Risk assessment indicators.

- Forecasting and simulation tools.

- Automated audit trails.

These systems identify potential compliance risks before they materialise, evaluate the impact, and suggest corrective actions – often without human intervention.

This helps businesses stay ahead of regulatory changes, avoid fines, maintain trust, and optimise internal processes.

2. Why This Trend Is Picking Up in 2025

a) Regulation Complexity is Increasing

Multiple regulatory bodies, cross-border rules, and dynamic requirements require more than manual compliance checks.

b) Real-Time Reporting Expectations

Authorities and partners expect compliance that’s instantaneous and continuously monitored.

c) AI Tools & Automation Are Now Affordable

SMEs no longer need enterprise budgets to deploy AI-powered solutions.

d) Risk Mitigation Has Become Strategic

Boards and investors now demand proactive compliance governance – not just paperwork.

e) Audit & Litigation Preparedness

Predictive systems maintain complete audit logs, making legal defense simpler and faster.

3. Key Features of Predictive Compliance Systems

i) Real-Time Regulatory Alerts

Systems pull in legal/regulatory updates as soon as they are published.

ii) Automated Risk Scoring

AI assigns risk scores to processes or filings based on probability and impact.

iii) Predictive Violations Forecasting

Forecast models simulate likely violations before deadlines or audits.

iv) Interactive Dashboards & Reporting

Live dashboards that visualise compliance health, KPIs, and risk heatmaps.

v) Automated Documentation & Audit Trails

All changes, filings, approvals and alerts are tracked automatically – reducing human error and documentation gaps.

4. Business Benefits of Predictive Compliance

- Reduced Penalties & Fines.

- Lower Administrative Overhead.

- Faster Response to Regulatory Changes.

- Better Governance & Board Confidence.

- Improved Data Accuracy.

- Integration With Business Processes.

- Risk Forecasting and Mitigation.

Predictive compliance turns compliance from a cost center to a strategic risk management tool.

Conclusion

In 2025, compliance isn’t just about meeting requirements – it’s about anticipating regulatory shifts and safeguarding business continuity. Predictive compliance management, powered by AI and real-time monitoring, is the next evolution in business governance.

Whether you’re operating locally or across states, having a predictive approach to compliance not only avoids fines – it builds trust, accelerates growth, and makes your business future-ready.

Leave a Reply