Dynamic Entity Registration: The Next Wave in Business Structuring for Startups & SMEs in 2025

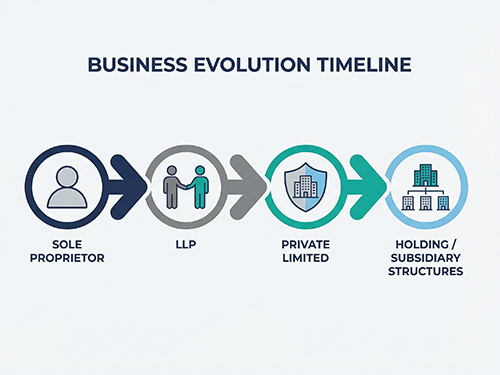

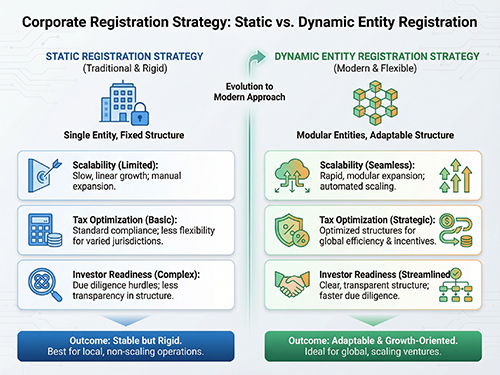

Traditional business registration usually involves selecting one structure – Sole Proprietor, Partnership, LLP, Private Limited, etc. – early in inception and sticking with it through growth phases. But in 2025, a new trend is emerging: Dynamic Entity Registration – a flexible, future-ready approach that allows businesses to adapt their legal structure as they grow, diversify, and operate across markets.

Dynamic registration means planning your structure for today’s needs while building in optionality for tomorrow’s opportunities – and aligning legal identity with your growth, tech adoption, taxation strategy, and regulatory environments.

1. What Is Dynamic Entity Registration?

Dynamic Entity Registration is the practice of choosing an initial registration model while planning structured transitions that can be activated with growth triggers.

Instead of:

- Incorporate once & stay static.

You get:

- Plan for Phase 1 → Phase 2 → Phase 3 structures.

For example:

- Start as a Sole Proprietorship or Partnership for simplicity

Transition to LLP or Private Limited as revenue and compliance needs scale. - Add a Holding Company or OPC if required by investors.

- Expand with Foreign Entity registration when entering overseas markets.

This strategy is not just registration – it’s registration as an evolving business architecture.

2. Why Dynamic Registration Is Trending in 2025

a) Startups Don’t Stay Small – They Scale Fast

Tech, SaaS, subscription models, and marketplace platforms often pivot business models within months – not years.

b) Investors Want Future-Ready Legal Structures

VCs and angels prefer entities that can issue ESOPs, convertible notes, or structured shares – which static structures may not support.

c) Multi-Jurisdiction Expansion Demands Flexibility

Digital businesses often sell across states and countries – requiring entity adjustments without rigid re-registration hurdles.

d) Tax Efficiency Needs Change With Growth

Different revenue levels and transaction types attract different tax impacts – and structures matter.

e) Regulatory Clarity Through Phased Registrations

Rather than reactive restructuring, planned structural evolution improves compliance clarity and reduces costs.

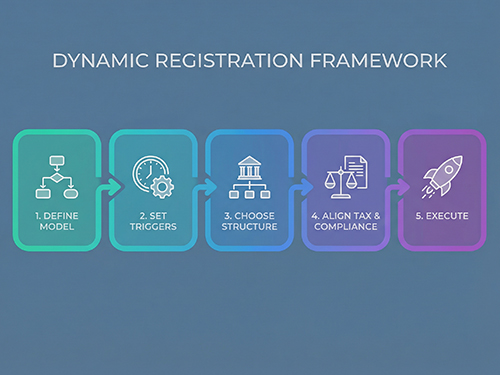

3. How to Plan Dynamic Registration – Step-by-Step

Step 1: Define Your Business Model & Market

Digital, product, service, B2B, cross-border, hybrid? Your entity should support your primary business direction.

Step 2: Map Growth Triggers

Revenue thresholds, funding rounds, employee count, legal exposure points – decide ahead what structure makes sense at each stage.

Step 3: Choose an Entry Structure With Options

Start with a form that is easy and low-cost but convertible – e.g., LLP or OPC with a roadmap to Private Limited.

Step 4: Document a Transition Framework

Set in place legal, financial, and compliance checklists for each transition event.

Step 5: Align With Tax & Compliance Strategy

Each structure change has tax implications – plan with advisors.

Step 6: Execute When Milestones Hit

Don’t force change prematurely – follow objective triggers.

This transforms registration from a one-time task into a strategic roadmap.

4. Business Benefits of Dynamic Entity Registration

- Reduced restructuring costs over time.

- Better investor & lender confidence.

- Optimized tax and compliance path.

- Aligned legal identity with business strategy.

- Ability to pivot legally without disruption.

- Improved scalability with clear exit/entry plans.

Dynamic registration is not “change for the sake of change.” It’s planning for legal evolution in harmony with business evolution.

Conclusion

Businesses in 2025 must think beyond static registration and adopt dynamic, phased, intentional entity planning. Whether you’re a startup preparing for growth or an SME eyeing international expansion, Smart Registration Planning gives you agility, certainty, and a structured path for change.

Leave a Reply