AI-Driven Working Capital Optimization & Embedded Finance: The Next Evolution in Business Finance (2025)

Managing working capital-ensuring there’s enough cash to meet short-term obligations and operational needs-is an enduring challenge for businesses of all sizes. Traditionally, this involved periodic reviews, manual forecasting, and often reactive decision-making.

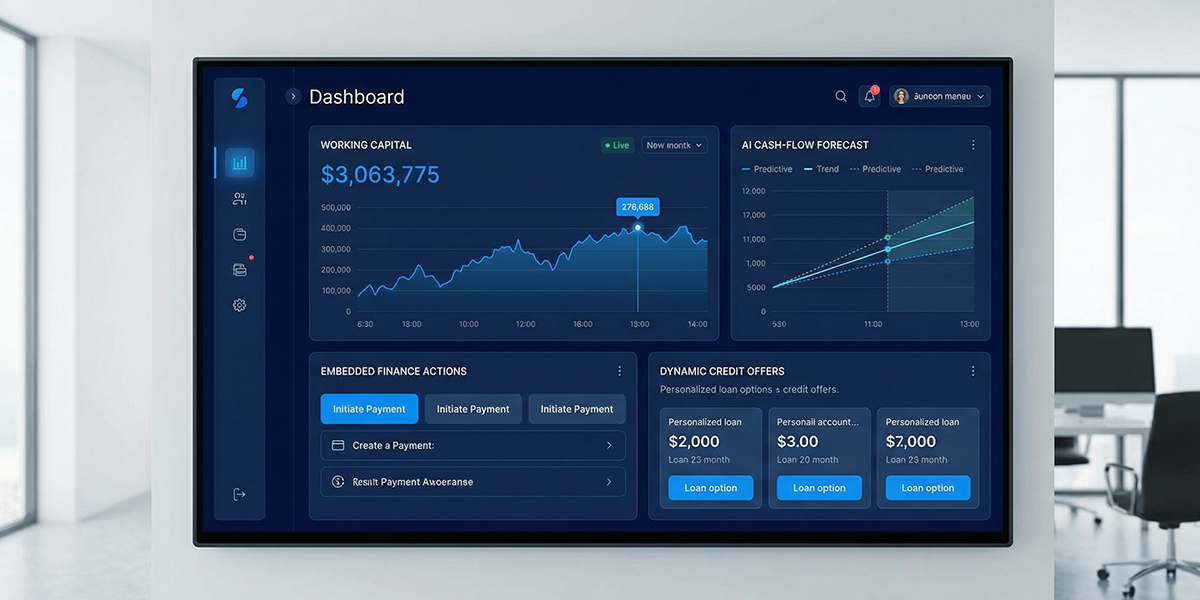

In 2025, businesses are shifting to data-driven working capital optimization using AI forecasting models and embedded finance tools. These systems analyze real-time transactional data, predict cash flow requirements, and automate financing actions right within operational platforms such as ERP, accounting software, and sales systems.

This approach is transforming how companies manage liquidity, reduce financing costs, and improve financial resilience.

1. What Is AI-Driven Working Capital Optimization?

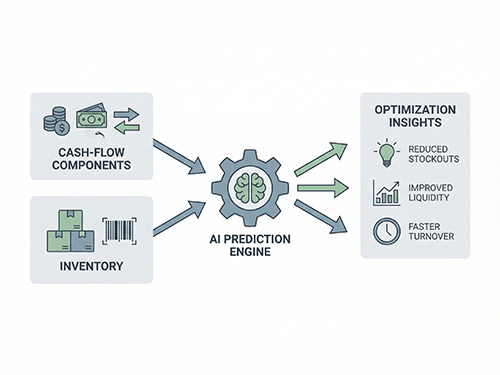

Working capital optimization powered by AI refers to using machine learning models and predictive algorithms that:

- Analyze historical financial data (receivables, payables, inventory).

- Predict future cash requirements & surplus periods.

- Suggest operational strategies to align payables and receivables.

- Recommend embedded financing options when needed.

- Simulate multiple “what-if” scenarios (e.g., delayed collections, supplier terms).

Instead of guessing overlays or rigid forecasts, finance teams get real-time insights and actionable recommendations.

2. The Role of Embedded Finance

Embedded finance refers to financial services (lending, payments, credit decisions, automated financing) being offered within non-financial systems such as ERP, accounting platforms, or sales dashboards.

Examples include:

- Instant working capital loans triggered by cash shortfall predictions.

- Extended supplier credit based on AI confidence scores.

- Automated invoice financing options at checkout.

- Dynamic discounting offered inside procurement platforms.

- Integrated payment facilitation via UPI or digital wallets.

For the first time, finance decisions are made in context – as part of operations – not separate standalone processes.

3. Why This Trend Is Critical in 2025

a) Cash Flow Uncertainty Requires Proactive Solutions

With economic fluctuations, businesses can’t wait for month-end reports – they need dynamic control.

b) AI & Machine Learning Are Mainstream

AI analysis is no longer experimental – it’s core to revenue, operations, and now finance.

c) Rapid FinTech & API Integration

Finance tools can now plug into business systems easily – making embedded finance practical.

d) SMEs Need Access to Smart Financing

Small and medium enterprises often face cash crunches; integrated finance solutions offer timely support without heavy paperwork.

e) Stakeholders Demand Visibility and Control

Investors and lenders want real-time financial intelligence – not just periodic reports.

4. Key Benefits of AI + Embedded Working Capital Solutions

i) Improved Liquidity Forecasts – understand your future cash flows with machine precision

ii) Lower Financing Costs – automated financing only when needed

iii) Reduced Cash Conversion Cycle – optimize payables and receivables timing

iv) Better Supplier & Customer Terms – dynamic discounting & credit options

v) Real-Time Financial Confidence – dashboards that guide next moves

This transforms working capital from a constraint to a strategic advantage.

Conclusion

AI-Driven working capital optimization and embedded finance are not just trends – they represent a fundamental shift in business finance. Companies that adopt these solutions gain agility, reduce costs, and stay ahead in liquidity management.

If you’re ready to transform your financial operations with predictive working capital planning and integrated finance tools, BOW’s Business Finance Services can guide you.

Leave a Reply