Tax Strategy in the AI Era: Predictive Tax Planning & Adaptive Compliance for 2026

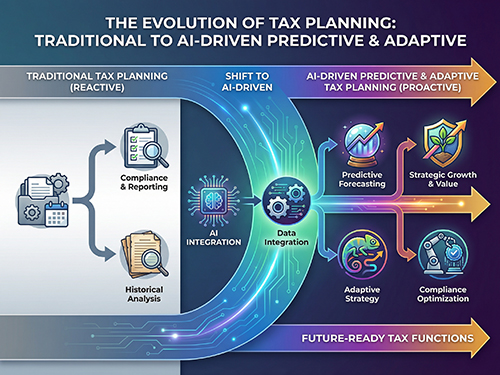

Gone are the days when tax planning was simply about end-of-year filing and compliance checklists. Today’s successful businesses leverage predictive tax planning powered by AI and real-time accounting systems to model tax outcomes throughout the financial year, optimize liabilities, and stay ahead of regulatory changes.

This new approach – combining predictive forecasting, adaptive compliance, and strategic tax design – transforms tax from a mandatory task into a decisive business advantage.

1. What Is Predictive Tax Planning & Adaptive Compliance?

- Predictive Tax Planning uses data from your accounting systems, cash flow trends, operations, and AI analytics to forecast tax liabilities under different scenarios – e.g., hiring, capex, expansion, new revenue streams – before they occur.

- Adaptive Compliance refers to systems that automatically adjust planning and reporting based on live regulatory changes, local and international tax law shifts, and compliance requirements – ensuring you don’t retroactively catch surprises at year-end.

Together, they provide a continuous tax strategy rather than a once-a-year form-filling process.

2. Why This Is Critical in 2026

a) Constant Regulatory Changes

Tax laws evolve frequently – GST amendments, corporate tax clarifications, digital tax rules – making static annual planning obsolete.

b) AI & Real-Time Accounting Tools

Modern accounting systems collect live transaction data, enabling better forecasting and accuracy in tax projections.

c) Global Operations Demand Agile Planning

Businesses operating in multi-jurisdiction environments must adapt quickly to local filing requirements and treaty impacts.

d) Investors & Auditors Expect Visibility

Real-time predictive tax insights improve governance and transparency – valuable in fundraising, audits, financing, and valuations.

e) Cash Flow Optimization

By modeling tax impact before business decisions (e.g., hiring, CAPEX, loan restructuring), companies can shape operations for better net outcomes.

3. Key Elements of Predictive Tax Strategy

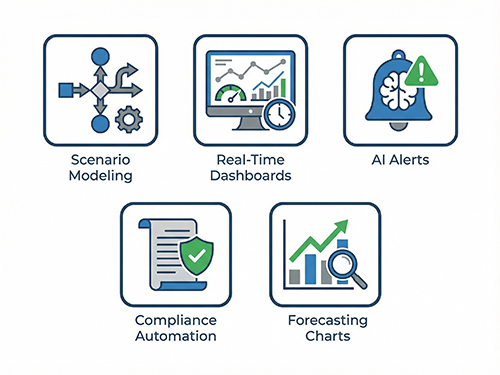

i) Scenario Modeling

Simulate different tax outcomes for decisions like hiring, investment, pricing changes, or international expansion.

ii) Real-Time Tax Dashboards

Visual dashboards reflect current estimated liabilities, return projections, deadlines, and risk indicators.

iii) AI-Driven Alerts & Compliance Rules

Automated alerts for:

- changing GST rules.

- TDS/TCS variations.

- updated deduction norms.

- cross-border regulatory shifts.

iv) Tax Impact Forecasting

Predict future tax liabilities under multiple business conditions to decide before acting.

v) Automated Document Generation

AI drafts typical compliance documents, returns, note disclosures, and audit schedules – reducing manual effort.

These elements turn tax planning into a living, strategic system rather than a one-time exercise.

4. How AI & Real-Time Accounting Support This Shift

Modern accounting platforms (cloud ERP, AI tools) provide:

- Continuous transaction monitoring

- Auto-classification of tax categories.

- Live feed of receivables/payables.

- Forecasting of liabilities with visualization.

- Integration with tax regulatory updates via API.

This empowers finance teams to adjust strategy step by step – versus bulk computation only at year-end.

5. Benefits for Businesses

- Better cash flow planning.

- Lower tax surprises and penalties.

- Faster compliance readiness.

- Strategic business decisions informed by tax impact.

- Improved investor confidence.

- Reduced audit friction.

- Competitive advantage through proactive planning.

This is why predictive tax strategy isn’t just a buzzword – it’s a game changer.

Conclusion

In 2026, tax planning is evolving into a continuous, adaptive, data-driven strategic asset. Predictive tax planning and adaptive compliance help businesses anticipate liabilities, optimize decisions, and reduce risk in real time.

If you’re ready to move beyond reactive tax compliance and embrace strategic tax insights, BOW’s Accounting & Tax Planning Services can guide you with expert support and cutting-edge tools.

Leave a Reply