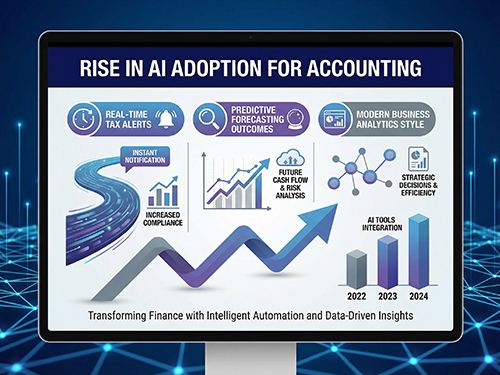

Real-Time Tax Optimization & AI-Enhanced Accounting: Business Finance in 2025

Accounting and tax planning used to be backward-looking chores – annual reconciliations, paperwork, and late filings. Today, thanks to AI, automation, and real-time financial tracking, accounting and tax planning have transformed into proactive strategic tools.

In 2025, forward-looking businesses aren’t just meeting compliance – they’re optimizing tax liabilities continuously, forecasting tax impact before transactions occur, and aligning accounting processes with real-time data for smarter decision-making.

This is the future of accounting & tax planning: AI-driven, real-time, optimized for growth.

1. What Is Real-Time Tax Optimization & AI-Enhanced Accounting?

This trend brings together:

- Live financial data processing.

- AI-assisted tax forecasting.

- Continuous compliance monitoring.

- Automated journal entries & reconciliations.

- Predictive tax liability alerts.

- Scenario-based planning & optimization recommendations.

Instead of waiting for month-end or year-end, businesses can now:

- see tax impact in real time.

- simulate different business decisions and their tax consequences.

- generate proactive tax strategies.

- continuously reconcile accounts via automation.

Accounting moves from “recording the past” to shaping the future.

2. Why This Is Trending in 2025

a) AI & Automation Have Entered Finance

AI now handles repetitive tasks – freeing finance teams to focus on strategic planning rather than manual entries.

b) Real-Time Tax Data Means Zero Surprises

Tax heads no longer wait for end-of-year shocks; alert systems catch issues early.

c) Mobile & Cloud Accounting Tools

Today’s businesses operate across locations – accounting software now runs in the cloud with live collaboration.

d) Businesses Demand Strategic Value from Accounting

Owners want insights, not just numbers – e.g., “What happens if we hire?” “What if we expand?” “How would a tax change impact profits?”

e) More Regulators Accept Digital/Near-Instant Reporting

Tax authorities increasingly support API-based reporting, livestream tracking, and automatic compliance triggers.

3. Key Components of Next-Gen Accounting & Tax Planning

i) AI-Assisted Transaction Classification

Auto-categorizes expenses, detects anomalies, and reduces human error.

ii) Predictive Tax Forecasting

Simulates tax impact for scenarios like hiring, purchases, expansion, investments.

iii) Live Cash-Flow & Tax Dashboards

Shows current cash balance, GST liabilities, payroll tax impact, and working capital in one place.

iv) Continuous Compliance Alerts

Reminders and warnings for filing deadlines, regulatory changes, or tax threshold breaches.

v) Automated Reconciliations

Software matches bank data, invoices, receipts, and produces reconciled statements automatically.

This moves tax planning from a reactive annual exercise to a continuous strategic activity.

4. How Businesses Benefit

- Avoid penalties & surprises.

- Optimize tax strategy year-round.

- Make better hiring/expense/investment plans.

- Save time with automation.

- Get deeper financial insights instantly.

- Integrate accounting with business strategy.

Real-time tax optimization gives SMEs the same data power that large enterprises have long enjoyed – without heavy investments.

Conclusion

Accounting and tax planning in 2025 is not about filing returns or maintaining ledgers after the fact – it’s about continuous intelligence, predictive insights, and strategic planning.

Businesses that adopt real-time accounting systems and AI-powered tax optimization tools gain foresight, stability, and a measurable edge over competitors.

Leave a Reply