Embedded Finance & Real-Time Cash-Flow Intelligence: The New Backbone of Business Finance in 2025

Business finance is no longer limited to bank accounts, balance sheets, or year-end reviews. In 2025, companies are moving toward embedded finance and real-time cash-flow intelligence-where financial tools are built directly into everyday business platforms.

From automated collections to live cash-flow tracking, businesses now manage money inside their operational systems, enabling faster decisions, stronger liquidity control, and reduced financial risk.

1. What Is Embedded Finance in Business?

Embedded finance means integrating financial services directly into non-financial business platforms such as:

- Accounting software.

- ERP systems.

- Billing & invoicing tools.

- E-commerce platforms.

- Payroll systems.

Instead of switching between banks, spreadsheets, and apps, businesses can:

- Collect payments instantly.

- Automate payouts.

- Track receivables and payables.

- View live cash positions.

- Trigger financial actions automatically.

Finance becomes part of operations, not a separate task.

2. Why Real-Time Cash-Flow Intelligence Is Trending in 2025

a) Businesses Need Instant Visibility

Monthly reports are too late. Companies want to see today’s financial position to make today’s decisions.

b) Faster Decision-Making

Real-time dashboards help businesses decide when to invest, hire, delay expenses, or push collections.

c) Uncertain Market Conditions

Volatile markets demand tighter liquidity management and early warning signals.

d) Automation Is Replacing Manual Finance

AI-driven cash-flow forecasting reduces human error and saves time.

e) SMEs Want Enterprise-Level Finance Tools

Affordable embedded solutions give small businesses the same power as large corporations.

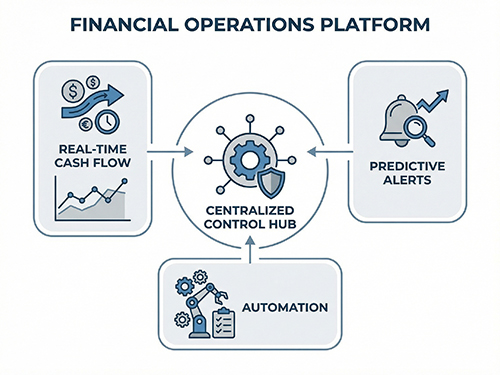

3. Key Features of Modern Business Finance Systems

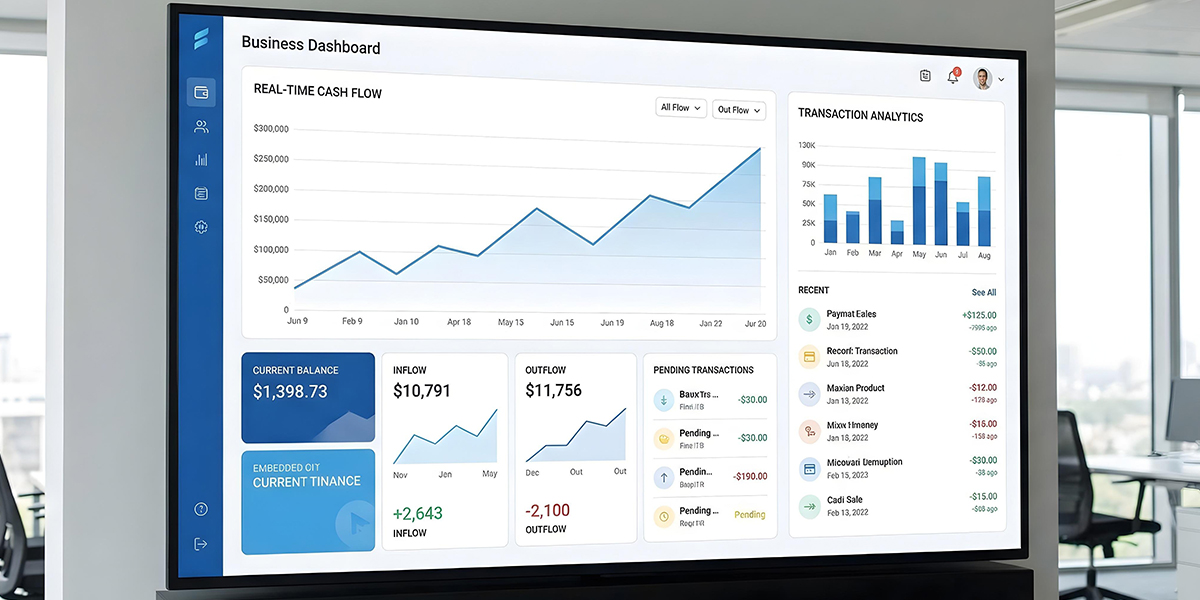

i) Live Cash-Flow Tracking

Instant view of inflows, outflows, and balances.

ii) Predictive Cash Alerts

AI flags potential shortfalls before they happen.

iii) Automated Receivables & Payables

Invoices, reminders, and payments run automatically.

iv) Embedded Credit & Payouts

Finance actions triggered inside business workflows.

v) Centralized Financial Control

All money movements visible in one place.

These features help businesses shift from reactive finance to proactive financial control.

4. How This Transforms Business Financial Management

Businesses using embedded finance and real-time intelligence experience:

- Better liquidity control.

- Fewer cash crunches.

- Faster collections.

- Improved vendor relationships.

- Stronger financial planning.

- Higher operational efficiency.

Finance teams move from bookkeeping to strategic advisory roles.

Conclusion

In 2025, business finance is no longer about looking backward-it’s about real-time insight and embedded control. Companies that integrate finance directly into their operations gain speed, clarity, and resilience.

By adopting embedded finance and cash-flow intelligence, businesses can make smarter decisions, avoid surprises, and build a stronger financial foundation for growth.

Leave a Reply