GST 2.0: Weddings, Wardrobes, Wallets – and the Future of India’s Economy

India has always been a land where economics and culture walk hand in hand. Festivals, weddings, and family milestones often shape not just personal memories, but also national spending trends. Against this backdrop, the government’s recent rollout of GST 2.0 is more than just a tax reform — it is a reset button that touches how we shop, celebrate, and dream.

What Has Changed: The New Tax Landscape

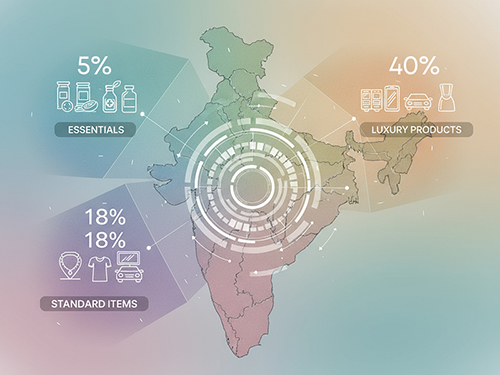

The Goods and Services Tax, first introduced in 2017, simplified India’s tax regime. Now, eight years later, GST 2.0 arrives with a fresh structure:

- 5% GST on budget-friendly apparel and essentials

- 18% GST on mid- to high-end clothing and several premium categories

- 18% GST on small cars (down from higher rates earlier)

- 40% GST cap on luxury vehicles (replacing steeper duties)

The reform is bold: while it may cost the exchequer nearly ₹1 trillion in revenue, it is expected to revive consumer demand and fuel India’s growth engine.

Weddings & Wardrobes: Culture Meets Commerce

For millions of families preparing for weddings and festivals, GST 2.0 has arrived as a timely blessing.

- Affordable fashion gets cheaper: Everyday apparel and festive wear in the budget segment will now be within easier reach of middle-class households.

- Premium wedding wear taxed higher: The reform gently nudges consumers to rethink lavish spending on luxury fabrics and designer collections, making celebrations more cost-conscious but still joyful.

- Wardrobe shifts: With price benefits trickling down, mid-range and budget fashion brands are set to experience a surge in demand, while premium labels may adapt with new strategies.

In essence, GST 2.0 reflects India’s cultural truth: weddings and festivals must remain vibrant, but the system ensures broader participation by empowering more families to celebrate within their means.

The Auto Sector: A Festive Gift on Wheels

If clothing is about expression, cars are about aspiration. GST 2.0 cuts taxes on small cars to 18%, while capping luxury car taxes at 40%.

- Automakers like Maruti Suzuki and Tata Motors have already announced price cuts.

- For first-time buyers and middle-class families, owning a small car just became more realistic.

- The festive season, traditionally a time for big-ticket purchases, is expected to see showrooms buzzing with renewed energy.

By lowering entry barriers, the government has rekindled India’s auto dream — a move that not only benefits households but also revives a sector that employs millions.

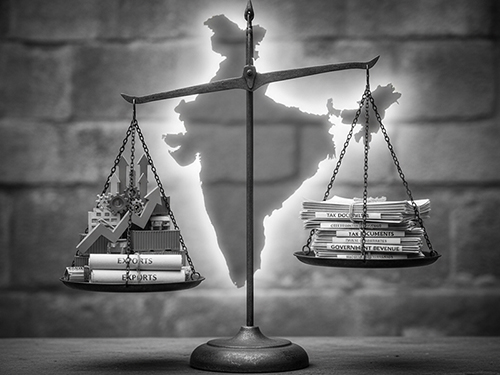

The Bigger Picture: Balancing Growth and Revenue

Critics point out that GST 2.0 could dent government revenues. Yet, the reform is a calculated tradeoff. Lower taxes mean more money in consumers’ hands. When households spend on clothes, cars, and celebrations, the ripple effects extend to manufacturing, logistics, services, and even digital platforms.

This is the classic cycle of stimulus-led growth: a short-term dip in collections paving the way for long-term prosperity.

Opportunities for MSMEs and Retailers

GST 2.0 is also a chance for small businesses and MSMEs to shine.

- Textile clusters in places like Surat, Tiruppur, and Varanasi can expand production to meet rising apparel demand.

- Auto component manufacturers across Tier-2 cities will benefit from revived vehicle sales.

- Local retailers and e-commerce sellers will find festive shoppers more willing to spend.

For MSMEs, the message is clear: adapt quickly, digitize supply chains, and seize the demand wave.

Why GST 2.0 Matters Beyond Numbers

At its core, this reform is not only about taxes but about confidence. It signals a government that listens to the pulse of its people, understands cultural rhythms, and is willing to trade short-term revenue for long-term vitality.

In India, the economy is not an abstract figure — it is lived through weddings, festivals, food, and family. GST 2.0 is designed to keep that heartbeat strong.

GST 2.0 is not just a reform. It is a reminder that when policy aligns with culture, the economy doesn’t just grow — it celebrates.

Leave a Reply