Pre-Filled Tax Returns 2.0: How AI-Powered Auto-Filing Is Changing Tax Compliance in 2025

Tax filing is no longer the stressful, time-consuming activity it once was. With the government enhancing pre-filled tax return systems and integrating AI-powered data validation, 2025 has brought a new level of convenience for taxpayers. From auto-fetching TDS data to pre-populated income details, tax compliance is shifting toward a zero-error, zero-stress experience.

For individuals, freelancers, and business owners, understanding this upgraded system can save time, reduce penalties, and ensure accurate filing.

1. What Are Pre-Filled Tax Returns 2.0?

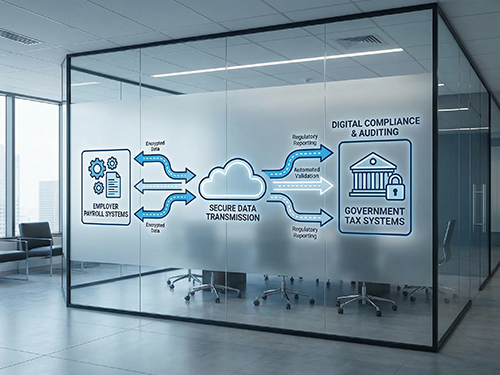

Pre-Filled Returns 2.0 go beyond basic auto-filling. The system now:

- Imports income data from employers, banks & mutual funds.

- Auto-validates TDS, TCS, interest income & dividends.

- Uses AI to detect mismatches & missing entries.

- Provides real-time accuracy checks before submission.

This means fewer manual entries and fewer errors.

2. Why This System Matters for Taxpayers

Pre-filled systems reduce filing burdens and ensure accuracy. Benefits include:

a) Time savings – fewer manual entries.

b) Error reduction – AI flags mismatches instantly.

c) Better compliance – reduces oversight and missed entries.

d) More transparency – taxpayers can see how data is sourced.

e) Reduced penalties – early detection of errors prevents notices.

For businesses, this simplifies seasonal workload and helps employees file stress-free.

3. How Businesses Can Leverage Pre-Filled Returns 2.0

Businesses can take advantage of this system by:

- Ensuring accurate payroll & TDS reporting.

- Using streamlined data pipelines with banks and vendors.

- Encouraging employees to use pre-filled forms.

- Reducing internal tax support workload.

- Minimizing compliance notices.

By syncing financial data earlier, businesses reduce year-end chaos and ensure smoother filing cycles.

Conclusion

AI-enabled tax filing is the future – and with Pre-Filled Returns 2.0, taxpayers gain convenience, accuracy, and peace of mind. Whether you’re an individual, freelancer, or business owner, leveraging these tools helps you stay compliant while reducing the stress of filing.

For expert help with filing, accuracy checks, or tax-planning – BOW is here to help you every step of the way.

Leave a Reply