AI-Powered Smart E-Filing & Pre-Filled Returns: The Future of Tax Filing in India

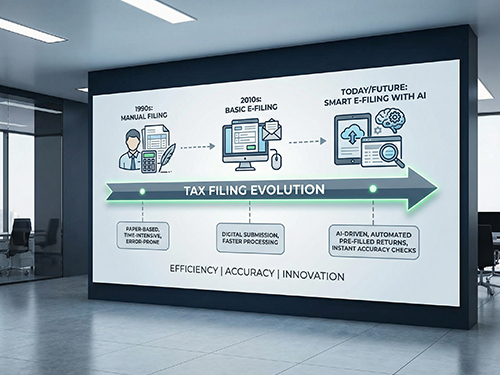

Tax filing in India has evolved significantly thanks to digital transformation. In 2025, the process is no longer a manual, year-end task – it’s becoming intelligent, streamlined, and user-centric, powered by automation, data integration and artificial intelligence.

From pre-filled return data to AI-suggested deductions, the new tax filing experience simplifies compliance, reduces errors, and makes the entire journey smoother for individuals and businesses alike.

1. What Is Smart E-Filing & Pre-Filled Returns?

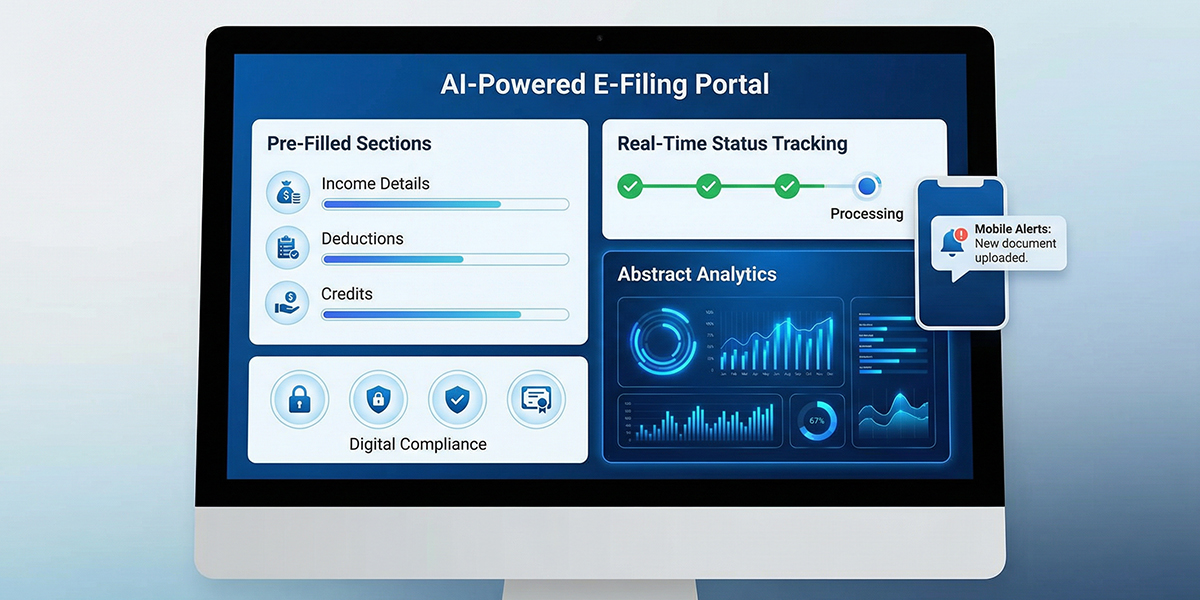

In 2025, the Income Tax Department’s e-filing ecosystem includes features like:

- Pre-Filled Income Tax Returns – automatic import of salary, TDS, bank interest and investment data into ITR forms.

- AI-Guided Suggestions – systems recommend deductions or anomalies based on taxpayer profiles and previous filings.

- Smart Dashboards – combined views of Form 26AS, AIS and other key data in one place.

- Mobile & UPI Integration – tax payment via UPI and mobile apps.

- Video e-Verification – online identity verification replacing in-person checks.

These innovations reduce manual error, improve accuracy, and make compliance easier for all taxpayer categories.

2. Why This Is Trending in 2025

a) AI & Automation Are Central to Tax Compliance

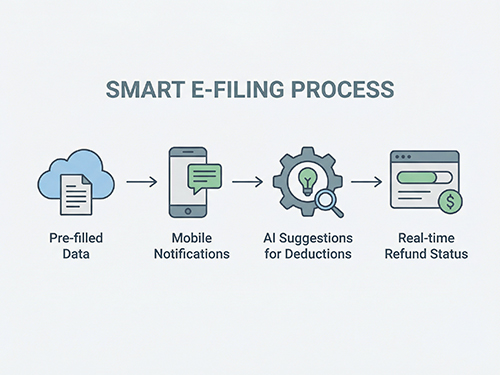

Tax authorities and private platforms alike are leveraging AI to validate data, detect anomalies and pre-fill forms – turning filing into a guided experience.

b) Increased Digital Data Integration

Banks, employers, brokers, and financial institutions now automatically feed TDS, interest and other financial details into the AIS/TIS feeds.

c) Better UX Through Mobile & Alerts

Mobile apps and WhatsApp/ChatGPT support help taxpayers track deadlines, monitor refunds and avoid last-minute mistakes.

d) Stronger Push for Voluntary Compliance

Tax departments are nudging individuals to revise returns before deadlines if discrepancies are found, especially around foreign assets or income.

e) Regulatory Modernisation on the Horizon

The new Income-tax Act, 2025 aims to simplify language, reduce forms and make compliance even more seamless from April 2026.

3. Key Features of AI-Enhanced Tax Filing

i) Pre-Filled ITR Forms

Income, TDS and KYC details already imported – reducing manual entry.

ii) AI Deduction Suggestions

Smart systems identify eligible tax breaks.

iii) Integrated Compliance Dashboards

Central view of AIS, TDS, refunds and notices in one place.

iv) Mobile Filing & UPI Payments

Pay taxes instantly via UPI apps during e-filing.

v) Real-Time Data Sync

Bank and investment details update weekly into AIS/TIS.

These features turn filing into a proactive, seamless, and error-resistant workflow.

4. How This Helps Taxpayers

- Less Manual Work – More Accuracy.

- Faster Filing & Fewer Errors.

- Clear Refund & TDS Visualization.

- Access On Mobile & Anytime.

- Smart Alerts & Timeline Tracking.

For businesses and individuals alike, embracing smart e-filing means saving time, reducing risk, and being compliance-ready year-round.

Conclusion

Tax filing in 2025 is no longer the annual “last-minute rush.” With AI-assisted pre-filled forms, mobile tools, integration across financial systems, and proactive compliance alerts, taxpayers can file faster, smarter – and stay compliant without stress.

If you need help navigating the latest tax filing innovations or ensuring accurate filing, BOW is here to support you with expert guidance.

Leave a Reply