The Hidden Cost of Running a Business Without Proper Compliance

Many entrepreneurs focus on ideas, operations, and growth-but unknowingly expose their business to financial losses, penalties, legal risks, and reputation damage due to non-compliance. In India, compliance is not just “paperwork”, Amma… it is a safeguard that protects your business from avoidable costs.

This article uncovers the real hidden costs that silently drain businesses which ignore compliance- and how BOW ensures you stay protected, prepared, and positioned for growth.

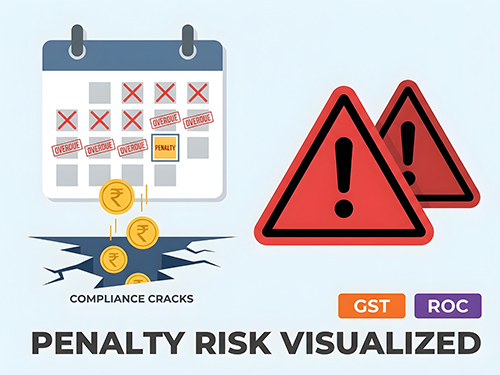

Penalties & Government Fines

Ignoring compliance deadlines such as GST submissions, ROC filings, PF/ESI updates, or license renewals can lead to heavy penalties. These fines accumulate monthly or even daily, becoming a large financial burden.

For many startups, this creates unnecessary monetary loss that could have been used for growth or marketing.

With BOW’s structured compliance tracking, you never miss deadlines-saving businesses from recurring fines.

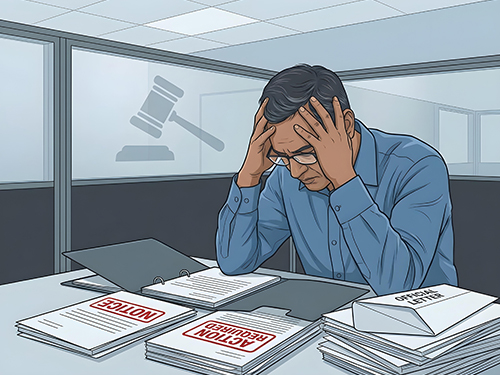

Legal Liability That Can Halt Operations

Unfiled documents, incorrect registrations, wrong legal structures, or missing business licenses can result in:

- Business closure notices.

- Legal notices.

- Operational restrictions.

- Frozen bank accounts in extreme cases.

Most entrepreneurs don’t realise that a missing compliance document can push the business into legal trouble.

BOW ensures your documentation, registrations, and filings are always aligned with legal requirements-so your operations never get interrupted.

Loss of Investor Trust

Investors look for businesses that are stable, structured, and compliant.

Lack of compliance results in:

- Investment rejections.

- Lower valuations.

- Due diligence failures.

- Loss of long-term trust.

A business with poor compliance history becomes high-risk.

BOW builds investor-friendly clarity by maintaining accurate records, clean filings, and complete documentation that prove business maturity.

Damage to Reputation & Customer Trust

Compliance issues can become public and harm the brand. Customers prefer businesses that operate transparently, especially when handling finances, products, or services.

When compliance is handled well, businesses appear reliable and credible.

BOW empowers growing companies to maintain a clean, trustworthy public profile through structured documentation and transparent processes.

Missed Opportunities for Growth

Non-compliant businesses often miss:

- Government tenders.

- Startup India benefits.

- MSME schemes.

- Export/import licenses

Bank loans. - Vendor partnerships.

Compliance is not an expense-it is a gateway to opportunities.

By partnering with BOW, businesses unlock access to new markets, funding, and government benefits.

Conclusion

The cost of non-compliance is not always visible, but it is always expensive. From penalties to investor losses, legal trouble to reputation damage-non-compliance affects every corner of your business.

With BOW as your compliance partner, you gain:

- Peace of mind.

- Continuous monitoring.

- Accurate documentation

- Zero missed deadlines

- A future-ready business

Compliance is not paperwork-it is protection. And BOW ensures your business stays safe, strong, and successful.

Leave a Reply