The Legal Documentation Every Company Must Master

Importing with Confidence: The Legal Documentation Every Company Must Master

Importing goods is one of the fastest ways for a company to grow – new suppliers, better margins, fresh product lines. But the door to global trade swings on paperwork: the right legal documents, filed correctly and on time. Below is a beautiful, practical guide you can use to publish on bow.org.in – clear, up-to-date, and written for busy founders, procurement heads and compliance teams.

Why documentation matters (and why you should care)?

Import compliance is more than bureaucracy. It protects your shipment from delays, avoids surprise taxes and penalties, unlocks schemes and duty benefits, and builds credibility with banks, customs and partners. Getting documents right reduces dwell time at ports, lowers demurrage costs and keeps your cashflows healthy. For importers, paperwork is risk management – and a competitive advantage.

Core documents checklist – the essentials (one-page ready list)

- Importer Exporter Code (IEC) – Your passport to trade. Issued by DGFT, IEC is mandatory for any import (and export) activity in India.

- Commercial Invoice – seller’s invoice with HSN/HS code, unit values, total value, currency, seller & buyer details. Critical for customs valuation.

- Packing List – detailed itemization, net/gross weights, dimensions, marks and packaging details (used by customs and warehousing).

- Bill of Lading (Sea) / Airway Bill (Air) – legal proof of shipment and contract with the carrier; required to release cargo.

- Bill of Entry (BoE) – the importer’s statutory declaration to Customs to clear goods; filed electronically (ICEGATE). It drives duty calculation and clearance.

- Insurance Certificate – proof that goods are insured during transit (marine/air insurance).

- Certificate of Origin (CoO) – required for preferential duty claims under FTAs and for some customs/clearance processes.

- Import License / Product-specific Approvals – mandatory for restricted items (e.g., pharma, certain chemicals, telecom equipment). Check DGFT and sectoral regulators.

- GST / PAN / AD (Authorised Dealer) Code – GST registration matching IEC is essential; banks issue AD code for foreign exchange remittances.

- Product Compliance Certificates (if applicable): BIS, FSSAI, CDSCO, Bureau of Indian Standards marking, EPR documentation, etc. These are product-specific and non-negotiable for clearance.

Step-by-step import flow (legal docs mapped to action)

- Before purchase – verify supplier, confirm Incoterms (FOB / CIF / DDP), and request Commercial Invoice + Proforma Invoice, Packing List, Certificate of Origin and any pre-requisite licenses. (Why: avoids surprises on arrival.)

- At shipment – carrier issues Bill of Lading / Airway Bill. Insurance certificate should be in place. Track the AWB / B/L number.

- Arrival & Customs filing – your CHA (Customs House Agent) or you file the Bill of Entry electronically on ICEGATE and upload digital documents (eSANCHIT). Customs assesses duties, inspects if required, and releases cargo after payment and formalities.

- Post clearance – reconcile invoices, lodge claims for any duty-credit schemes (if eligible), and maintain records for audits and GST purposes.

Digital-first: the modern compliance stack

India’s customs and trade systems have gone digital – and that changes everything for compliance speed:

-

- ICEGATE / eSANCHIT: file Bills of Entry, submit documents electronically and reduce physical paperwork at ports. This is now the standard channel for customs filing.

- Faster IEC & online DGFT services: IEC issuance and profile linking can be done via DGFT’s portal – reducing lead time for new importers.

- BE amendments & webforms: ICEGATE 2.0 supports BE amendments through webforms – handy for correcting classification, value or quantity post-filing. Keep an eye on the ICEGATE user manual for the latest process.

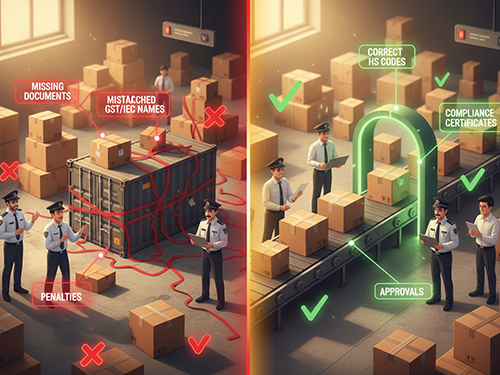

Common legal pitfalls (and how to avoid them)

- Mismatch of GST/IEC names – delays & rejections. Ensure PAN, GSTIN and IEC names exactly match.

- Incorrect HS codes / undervaluation – attracts penalty and re-assessment. Use a customs consultant for complex items.

- Missing product licenses (BIS, FSSAI, CDSCO) – consignments get detained until approvals are produced. Always confirm product compliance before shipment.

- No AD code – banks require AD (Authorized Dealer) code for forex remittance; missing this can block payment flows. Obtain AD code early via your bank.

Tips to speed up clearance and save costs

- Digitally pre-validate documents with your CHA before shipment arrival.

- Use complete, consistent product descriptions and HSN codes on invoices and packing lists.

- Opt for CIF/FOB clarity in contracts – know which party is responsible for customs formalities.

- Bundle approvals: if importing a family of products, arrange group BIS/FSSAI certifications where possible.

- Consider duty mitigation schemes (advance authorizations, RoDTEP, or FTA preferences) – but only after proper eligibility checks.

Small business corner – practical checklist for first-time importers

- Apply for IEC on DGFT (keep PAN, bank details, company address ready).

- Get GSTIN and ensure name/PAN consistency.

- Confirm product-specific licenses early (BIS/FSSAI/CDSCO).

- Contract with a trusted CHA and share digital copies of invoices and B/L early.

- Register on ICEGATE for e-filing and eSANCHIT uploads.

The trends shaping import compliance (what’s changing in 2025)

- Faster digital filings and ICEGATE enhancements (BE amendments via webforms), reducing manual interventions and correction windows.

- Greater emphasis on product compliance & sustainability (EPR, traceability) – importers increasingly asked for supplier due diligence and proof of origin.

- Integration with GST and banking systems for smoother reconciliation – more matching rules, so accuracy matters more than ever.

Final thoughts – treat paperwork as strategy, not chore

Legal documentation for importation is where trade transactions meet trust and law. Companies that systemize documentation, invest in digital filing, and build a predictable relationship with their CHA and bank will clear customs faster, lower costs, and scale imports with confidence.

Leave a Reply