Why Compliance is the New Competitive Advantage for Indian Startups in 2025

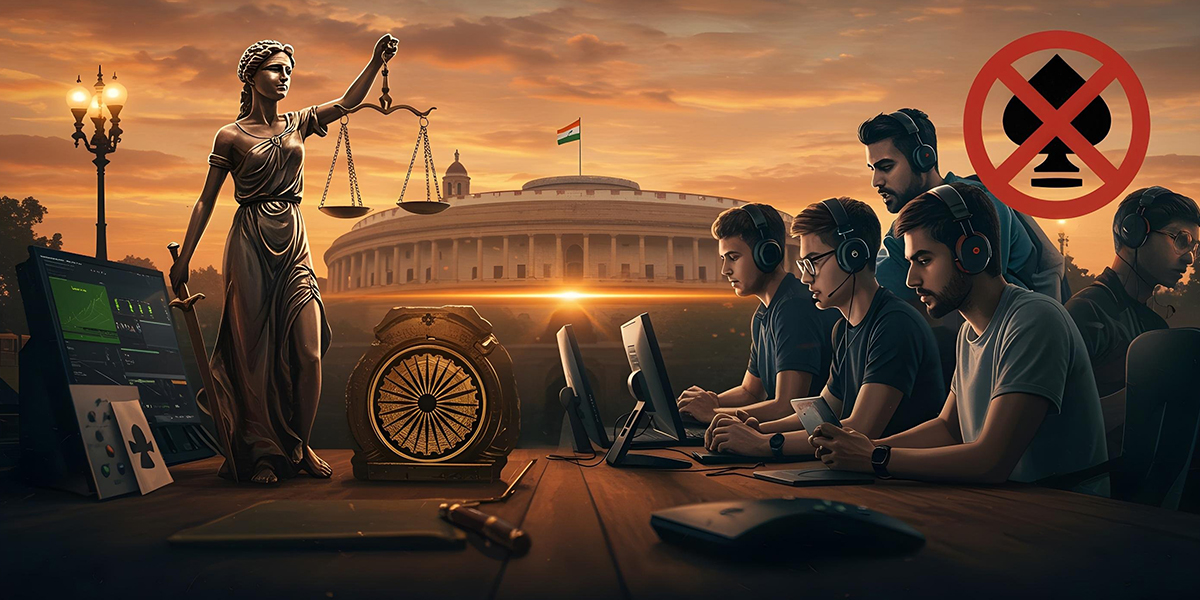

In 2025, Indian startups are moving faster than ever – from fintechs and AI ventures to small-scale manufacturers and service firms. Yet, as innovation accelerates, so do compliance challenges. Many startups treat legal compliance as an afterthought, but today, it has become a core business advantage.

Regulatory readiness builds credibility, attracts investors, and reduces risk – three essentials for sustainable growth.

At BOW we believe compliance isn’t a burden; it’s the foundation of business confidence.

1. Investor Confidence Begins with Compliance

Modern investors no longer fund ideas alone – they fund well-structured businesses. A company with updated registration, timely tax filings, and transparent documentation instantly stands apart.

By ensuring compliance with GST, income tax, and MCA filings, startups can present themselves as credible, responsible, and ready for long-term partnerships.

Insight: According to India’s startup ecosystem reports, nearly 40% of funding rejections in 2024 were linked to poor documentation or compliance gaps.

2. Automation & AI: The Future of Compliance

Technology has transformed how compliance is handled. AI-powered tools now automate tasks like tax filing, payroll, ITR management, and accounting – reducing manual errors and saving time.

BOW integrates these digital systems with human expertise to create a hybrid compliance model – fast, accurate, and accessible for every entrepreneur.

Example: Auto-reminders for GST deadlines, cloud-based data security, and e-signature-enabled legal documentation.

3. Building Trust Through Ethical Operations

Consumers and investors increasingly value transparency. When startups comply with laws – from labor regulations to data protection – they send a message of integrity and professionalism.

Compliance is not just a legal requirement; it’s a brand value.

At BOW, we help businesses establish ethical practices that align with both government standards and customer expectations.

4. How BOW Makes Compliance Simple

BOW’s platform simplifies every stage of your business journey –

- Registration: From sole proprietorships to private limited companies.

- Filing: GST, TDS, and income tax submissions with automated systems.

- Licenses: Assistance with FSSAI, import/export, and local business permits.

- Documentation: Ready-to-use deeds, agreements, and compliance templates.

- Advisory: Expert consultation to ensure accuracy and avoid penalties.

Our mission is to transform complex legal tasks into smooth, guided processes – helping you focus on growth while we handle the groundwork.

Conclusion

As India moves toward a digital-first economy, compliance is no longer optional – it’s a competitive edge.

The startups that survive 2025 will be those that build trust, transparency, and technology into their operations.

And with BOW by your side, compliance becomes a catalyst – not a challenge.

Leave a Reply